What You Need to Know About Investment Consulting

- Dead Money

- Oct 28, 2025

- 4 min read

Navigating the complex world of finance and investments can be a daunting task. The myriad of options, fluctuating markets, and evolving economic conditions require a steady hand and informed guidance. This is where the expertise of investment consultants becomes invaluable. Their role is to provide tailored advice and strategic planning to help individuals and investors achieve their financial goals. In this article, I will explore the multifaceted role of investment consultants, how they operate, and what one should expect when engaging their services.

The Role of Investment Consultants in Wealth Management

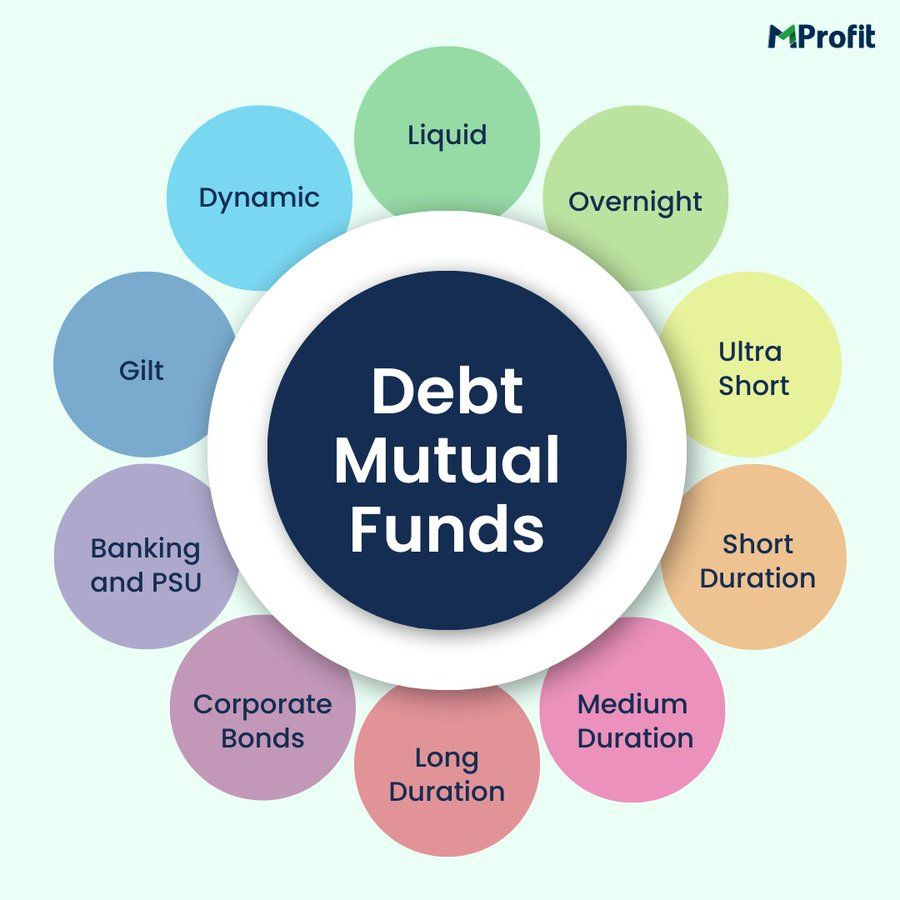

Investment consultants serve as trusted advisors who analyze an individual’s financial situation, risk tolerance, and long-term objectives. Their primary responsibility is to design and recommend investment strategies that align with these factors. Unlike brokers or financial advisors who may focus on selling specific products, investment consultants take a holistic approach. They evaluate a broad spectrum of investment opportunities, including equities, bonds, mutual funds, real estate, and alternative assets.

A key aspect of their role involves continuous monitoring and adjustment of portfolios to respond to market changes and personal circumstances. For example, if an investor’s risk appetite decreases due to approaching retirement, the consultant might recommend shifting assets from high-volatility stocks to more stable fixed-income securities. This dynamic approach ensures that the investment plan remains relevant and effective over time.

Investment consultants also provide education and clarity, helping clients understand the rationale behind each recommendation. This transparency fosters confidence and empowers investors to make informed decisions. Their expertise is particularly beneficial in complex scenarios such as tax planning, estate considerations, and navigating regulatory environments.

How Do Investment Consultants Get Paid?

Understanding the compensation structure of investment consultants is crucial for anyone considering their services. There are several common models, each with its own implications for the client-consultant relationship.

Fee-Based Compensation: This model involves charging a fixed fee or an hourly rate for consulting services. It promotes transparency and reduces potential conflicts of interest since the consultant’s income does not depend on the products recommended.

Assets Under Management (AUM) Fees: Many consultants charge a percentage of the assets they manage on behalf of the client. Typically, this fee ranges from 0.5% to 2% annually. This model aligns the consultant’s incentives with the client’s portfolio performance but may encourage a focus on asset accumulation.

Commission-Based Compensation: Some consultants earn commissions from financial products they sell. While this can lower upfront costs for clients, it may introduce bias towards certain investments.

Hybrid Models: A combination of fees and commissions is also common, balancing transparency with performance incentives.

Clients should seek clarity on the fee structure before engagement. A reputable investment consultant will provide a detailed explanation and a written agreement outlining all charges. This transparency helps build trust and ensures that the consultant’s advice remains objective and client-focused.

The Process of Engaging an Investment Consultant

Engaging an investment consultant typically begins with an initial consultation. During this meeting, the consultant gathers comprehensive information about the client’s financial status, goals, and preferences. This includes income, expenses, existing investments, liabilities, and future plans such as education funding or retirement.

Following this assessment, the consultant develops a customized investment plan. This plan outlines asset allocation, risk management strategies, and expected returns. It also includes contingency measures to address market volatility or unexpected financial needs.

Once the plan is approved, the consultant assists in implementing the strategy. This may involve selecting specific investment vehicles, coordinating with brokers, and setting up accounts. Importantly, the consultant remains engaged through regular reviews and updates, ensuring the portfolio adapts to changing circumstances.

For example, if an investor’s portfolio is heavily weighted in technology stocks and a market downturn occurs in that sector, the consultant might recommend diversification into other industries or asset classes to mitigate risk.

Key Qualities to Look for in an Investment Consultant

Selecting the right investment consultant is a critical decision that can significantly impact financial outcomes. Several qualities distinguish effective consultants from the rest:

Expertise and Credentials: Look for consultants with recognized certifications such as CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner). These credentials indicate a high level of knowledge and ethical standards.

Experience: A proven track record in managing portfolios similar to your financial profile is invaluable. Experienced consultants are better equipped to navigate market complexities.

Communication Skills: The ability to explain complex financial concepts in clear, understandable terms is essential. Regular updates and responsiveness to queries foster a strong client-consultant relationship.

Transparency: Openness about fees, potential conflicts of interest, and investment risks builds trust.

Client-Centric Approach: The consultant should prioritize your goals and preferences over product sales or commissions.

Engaging with a consultant who embodies these qualities increases the likelihood of achieving sustainable financial growth.

Practical Recommendations for Maximizing the Benefits of Investment Consulting

To fully leverage the advantages of professional investment advice, consider the following actionable steps:

Define Clear Objectives: Before consulting, articulate your financial goals, time horizons, and risk tolerance. This clarity enables the consultant to tailor strategies effectively.

Maintain Open Communication: Share any changes in your financial situation or goals promptly. This allows for timely adjustments to your investment plan.

Review Performance Regularly: Schedule periodic reviews with your consultant to assess portfolio performance and make necessary changes.

Educate Yourself: While consultants provide expertise, having a basic understanding of investment principles empowers you to engage more meaningfully in decision-making.

Be Patient and Disciplined: Investment growth often requires time and resilience through market fluctuations. Trust the strategic plan and avoid impulsive decisions.

By following these recommendations, individuals can enhance their financial security and work steadily towards their wealth management objectives.

Embracing Strategic Financial Growth with Expert Guidance

In the pursuit of financial prosperity, the role of investment consultants cannot be overstated. Their expertise, strategic insight, and personalized approach provide a foundation for informed decision-making and effective wealth management. Engaging a qualified consultant offers not only access to sophisticated investment strategies but also the reassurance of professional stewardship over one’s financial future.

For those seeking to navigate the complexities of investment landscapes, partnering with a trusted advisor is a prudent step. Through comprehensive analysis, tailored planning, and ongoing support, investment consultants help transform financial aspirations into achievable realities.

For more detailed information and professional assistance, consider exploring investment consulting, which offers a range of services designed to meet diverse financial needs.

Comments