Unveiling the Potential of the Indian Stock Market: A Journey of Opportunities

- Dead Money

- Dec 2, 2025

- 3 min read

Introduction

The Indian stock market has emerged as one of the most vibrant and promising investment destinations in recent years. With a rapidly growing economy, a robust regulatory framework, and a thriving investor ecosystem, it has captured the attention of both domestic and international investors. In this blog, we will delve into the fascinating world of the Indian stock market, exploring its key features, the factors driving its growth, and the opportunities it offers to investors.

1. A Thriving Economy

India's economy has been witnessing significant growth, propelled by various factors such as a young and dynamic workforce, technological advancements, and a burgeoning middle class. The stock market serves as a barometer of the economy's health and growth prospects, making it an attractive avenue for investors looking to capitalize on India's progress.

2. Diverse and Expanding Market

The Indian stock market offers a diverse range of investment options, including large-cap, mid-cap, and small-cap companies across various sectors such as information technology, banking, pharmaceuticals, consumer goods, and infrastructure. This diversity allows investors to create a well-rounded portfolio tailored to their investment goals and risk appetite. Moreover, the Indian stock market has witnessed an increasing number of companies going public, providing additional investment opportunities. The rise of startups and the government's push for initiatives like "Make in India" and "Digital India" have contributed to the growth of the Initial Public Offering (IPO) market, attracting both institutional and retail investors.

3. Regulatory Framework and Investor Protection

India has a well-established regulatory framework governed by the Securities and Exchange Board of India (SEBI). SEBI's role in ensuring transparency, fair practices, and investor protection has significantly enhanced the trust and confidence of investors in the Indian stock market. The introduction of measures like the Insiders Trading Regulations, Corporate Governance Guidelines, and periodic audits of listed companies further strengthens the integrity of the market.

4. Technological Advancements and Digital Transformation

The rapid advancement of technology has revolutionized the Indian stock market, making it more accessible and efficient for investors. Online trading platforms, mobile applications, and real-time market data have empowered investors to make informed decisions, execute trades seamlessly, and monitor their investments from the comfort of their homes. This digital transformation has opened up new avenues for retail investors to participate actively in the stock market.

5. Rising Investor Participation

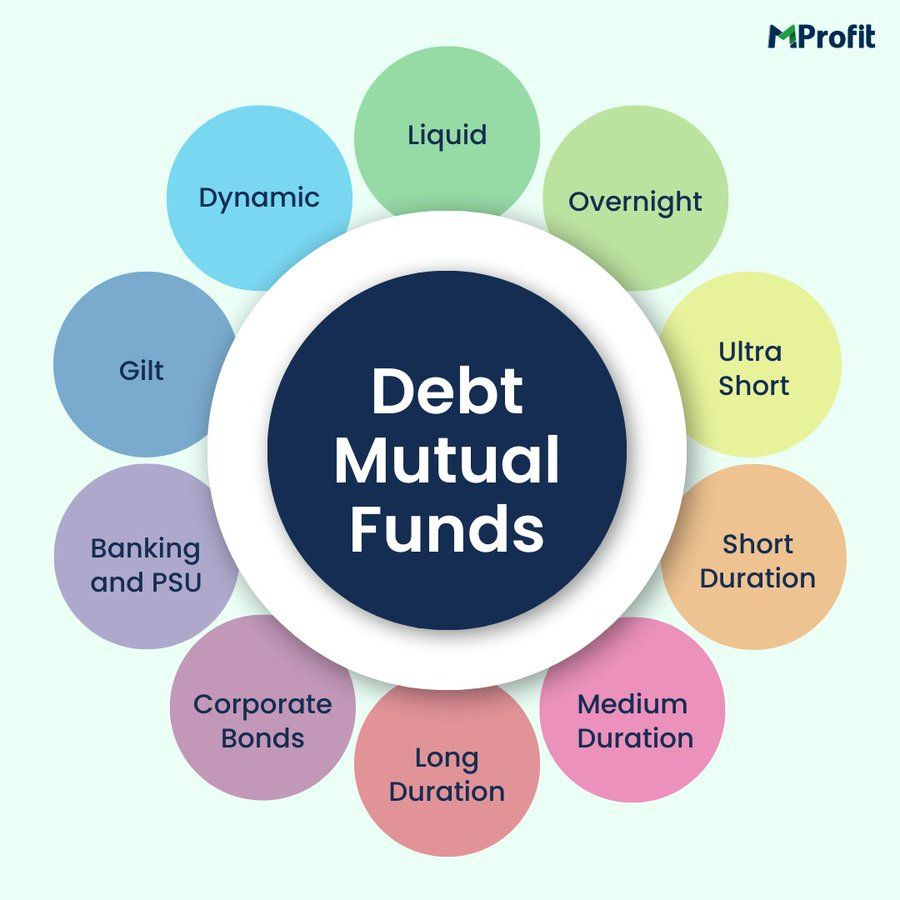

India's stock market has witnessed a surge in investor participation, driven by increased financial awareness, growing disposable income, and the availability of user-friendly investment platforms. Retail investors, once considered a negligible force, now play a significant role in shaping market trends. This trend is further bolstered by the availability of mutual funds, systematic investment plans (SIPs), and other investment instruments that cater to the diverse needs of investors.

6. Long-Term Growth Potential

Investing in the Indian stock market can provide investors with access to long-term growth opportunities. With its favorable demographics, expanding middle class, and increasing urbanization, India offers a fertile ground for companies to grow and flourish. Investors who adopt a long-term investment horizon can potentially benefit from the country's evolving consumer demands, infrastructure development, and technological advancements.

Conclusion

The Indian stock market stands as a gateway to immense potential and opportunities for investors. As India continues to consolidate its position as one of the world's fastest-growing economies, the stock market serves as a platform to participate in this growth story. However, it's important to note that investing in the stock market carries inherent risks, and careful research, risk assessment, and diversification are essential for successful investing.

To be a part of the Indian growth story you can join us at Ascentia Consulting Co LLP.

Comments