Top Strategies for Effective Investment Consulting in India

- Dead Money

- Nov 13, 2025

- 3 min read

Navigating the complex world of investments in India requires a well-thought-out approach. The dynamic economic environment, diverse financial instruments, and evolving regulatory framework make it essential to adopt strategies that are both prudent and adaptable. In this article, I will share insights into the top strategies for effective investment strategies in India, focusing on practical steps that can help secure financial growth and stability.

Understanding the Indian Investment Landscape

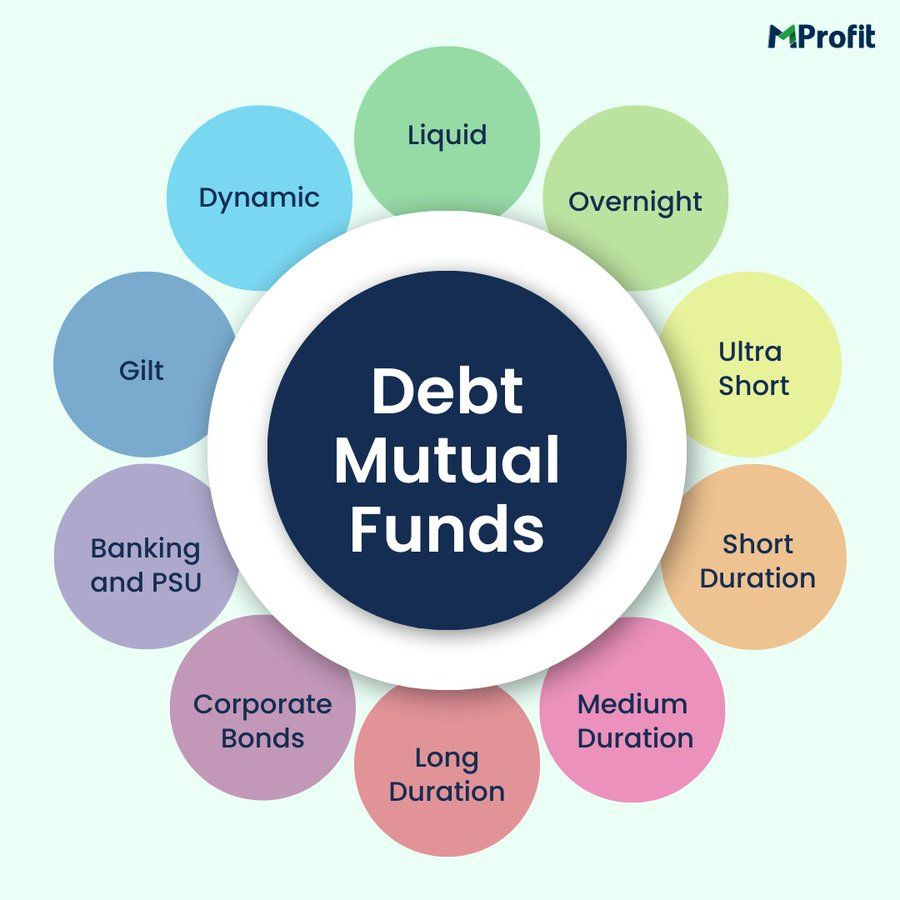

India's investment environment is characterized by a mix of traditional and modern financial instruments. From government bonds and fixed deposits to mutual funds and equities, the options are vast. Understanding the nuances of these instruments is the first step toward making informed decisions.

For example, fixed deposits offer safety and guaranteed returns but may not keep pace with inflation. Equities, on the other hand, provide higher growth potential but come with increased risk. Diversification across asset classes is therefore crucial to balance risk and reward.

The regulatory framework in India, governed by bodies such as SEBI (Securities and Exchange Board of India), ensures investor protection and market transparency. Staying updated with regulatory changes can help investors avoid pitfalls and leverage new opportunities.

Key Investment Strategies in India

When developing investment strategies in India, several factors must be considered to align with financial goals and risk tolerance. Here are some of the most effective approaches:

1. Diversification Across Asset Classes

Diversification reduces risk by spreading investments across different asset classes such as equities, debt, real estate, and gold. For instance, allocating a portion of the portfolio to government bonds can provide stability, while equities can drive growth.

2. Systematic Investment Plans (SIPs)

SIPs allow investors to invest a fixed amount regularly in mutual funds. This strategy benefits from rupee cost averaging, reducing the impact of market volatility. Over time, SIPs can build substantial wealth with disciplined investing.

3. Focus on Long-Term Growth

Investing with a long-term horizon helps ride out market fluctuations. Equity investments, particularly in blue-chip companies and index funds, tend to appreciate over time, offering capital gains and dividends.

4. Tax-Efficient Investments

Utilizing tax-saving instruments like Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS), and National Pension System (NPS) can enhance net returns by reducing tax liabilities.

5. Regular Portfolio Review and Rebalancing

Periodic assessment of the portfolio ensures alignment with changing financial goals and market conditions. Rebalancing helps maintain the desired asset allocation and manage risk effectively.

The Role of Professional Guidance

While self-directed investing is possible, professional guidance can significantly enhance decision-making. Engaging with experts who understand the intricacies of the Indian market can provide tailored solutions that match individual financial objectives.

One can benefit from investment consulting services that offer comprehensive analysis, risk assessment, and strategic planning. Such consulting helps in identifying suitable investment avenues, optimizing portfolios, and navigating regulatory complexities.

Risk Management and Mitigation

Effective investment strategies in India must incorporate risk management to safeguard capital. Some practical measures include:

Asset Allocation: Balancing high-risk and low-risk investments to suit risk appetite.

Emergency Fund: Maintaining liquidity to cover unforeseen expenses without disrupting investments.

Insurance: Protecting against life, health, and asset risks to prevent financial setbacks.

Market Research: Staying informed about economic trends, geopolitical events, and sectoral performance.

By proactively managing risks, investors can enhance the resilience of their portfolios.

Embracing Technology and Digital Platforms

The rise of digital platforms has transformed investment management in India. Online brokerage accounts, robo-advisors, and mobile apps provide easy access to markets and real-time information.

Utilizing these tools can improve efficiency, reduce costs, and enable better tracking of investments. However, it is essential to choose platforms with robust security measures and reliable customer support.

Building a Sustainable Investment Plan

Sustainability is gaining prominence in investment decisions. Incorporating Environmental, Social, and Governance (ESG) criteria can align investments with ethical values while potentially enhancing long-term returns.

Investors may consider funds and companies committed to sustainable practices, contributing to positive social impact alongside financial growth.

Final Thoughts on Strategic Investment Planning

Developing effective investment strategies in India requires a blend of knowledge, discipline, and adaptability. By diversifying portfolios, leveraging professional advice, managing risks, and embracing technology, investors can position themselves for sustained financial success.

The journey toward financial security is continuous and demands regular evaluation and adjustment. With a clear plan and informed choices, it is possible to navigate the complexities of the Indian investment landscape confidently and achieve meaningful wealth accumulation.

Comments