Importance of Systematic Investing

- Dead Money

- Nov 5, 2025

- 1 min read

Systematic investing is important for many reasons and has many benefits for investors:

Discipline: Good investment management financial discipline that requires you to invest regularly. This relationship can help you avoid stressful market swings, such as selling during a downturn or chasing business during a bull market.

Reduce risk: By investing periodically, you automatically buy more stock when pricesare low and less when prices are high. This average value is called cost averaging and can help minimize the impact of market fluctuations on your portfolio.

Reduce barriers to entry: Systematic investing allows people to start investing with less capital. You can start with a small monthly donation, making it accessible to all types of Investors.

Compound Growth: An investment technique that uses the power of interest over time. When your investments generate returns, the returns generate returns, causing your portfolio to grow exponentially.

Long-term perspective: Systematic investment encourages long-term perspective. By staying calm despite short term market fluctuations, you stay calm in the long run, which has historically led to better outcomes.

Reduce Timing Risk: Trying to time the market for a single investment can be difficult and risky. Strategic investing eliminates the need to predict market trends and reduces the risks associated with bad investments.

Savings and Achieving Goals: Good investing is learning the right way to save for specific financial goals, such as retirement, buying a home, or money. It allows you toconstantly work towards your goals.

Automatic and easy: This is an effective investment method. When you create a strategic investment plan, you need to put in very little effort. This convenience makes it suitable for busy people.Historical performance: Investments have historically produced good results over the long term, especially when compared to the market duration test.

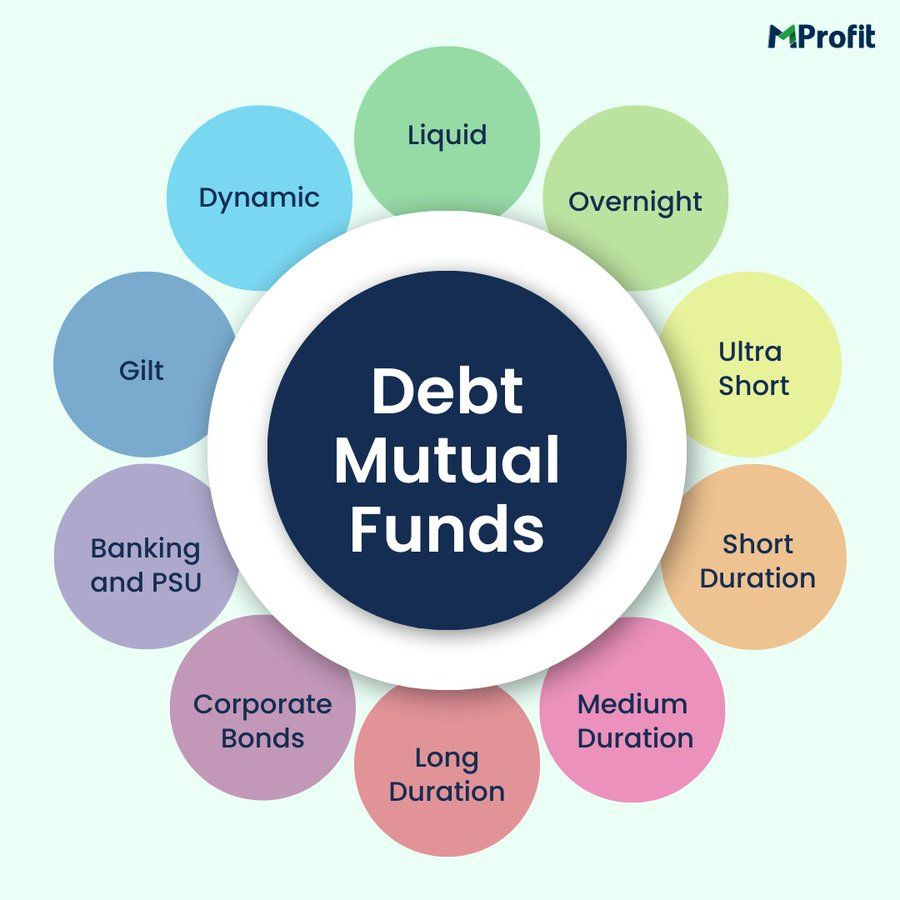

While value investing has many advantages, it is important to choose the right investment vehicle, such as mutual funds, exchange-traded funds (ETFs), stocks, bonds, etc based on your financial goals, risk tolerance and investment situation. stocks and bonds. You may also need to review and adjust your investment strategy as your situation changes. Consulting a financial advisor can help you create an investment plan based on your specific needs and goals.

Comments